We can go green at wartime speed

There is no technical or economic reason anyone should be forced to fund Vladimir Putin’s terror. The technology, policy tools, and finance, are available now to go green at wartime speed.

Can we phase out fossil fuel dependency at the speed required by ongoing emergencies?

The illegal invasion of Ukraine, by a military force financed by revenues from international energy markets, raises the question about how best to rapidly reduce dependency on imported oil and gas. We look here at four forces driving the political, economic, and financial calculus of the moment:

Energy prices and COVID driving inflation

Embedded oil and gas costs

Pervasive, escalating climate risk

The weaponization of oil and gas dependency

Our conclusion is that we do in fact have the policy, technology, and finance tools we need to phase out fossil fuel dependency at wartime speed, and that doing so will help us to secure our best possible economic future.

1) Energy prices, and their interactions with COVID pandemic conditions, are driving inflation.

Even a cursory look at which products are seeing the highest rate of inflation shows that oil and gas are the culprits. The rise in energy prices is far above any other rise in costs, including wages. What we are experiencing is a fossil fuel price shock, not systematized or spiraling inflation.

In 2021, we saw a complicated resurgence of demand.

Fuel was still needed for shipping, home-heating, and power production;

Petroleum byproducts were still very much in demand;

Vaccines were making it somewhat safer for people to travel, to gather in public, work in offices, and so demand surged;

But markets didn’t have clear signals, because temporary shutdowns were still happening, and delivery on futures contracts couldn’t be timed optimally.

In short, we were not yet back to pre-pandemic standards of operation, but demand was surging. That meant producers, refiners, distributors, and investors, had to build in a premium, to cover potential losses. Without sufficient supply to keep prices low, prices rose.

2) Embedded oil and gas costs create unwanted ripple effects.

Energy comprises a meaningful segment of the value chain behind prices of other goods and services. Speculative fuel price increases result in less cost-effective management scenarios for agricultural products, and other major internationally traded goods.

We can already see how the ongoing global energy price spike is affecting consumer goods, and interfering with inclusive and sustainable economic recovery from the COVID shutdowns. To reduce the likelihood of price spikes from shock events, we need to remove embedded fossil fuel costs from value chains.

3) Pervasive, escalating climate risk makes it necessary to move away from fossil fuels, now.

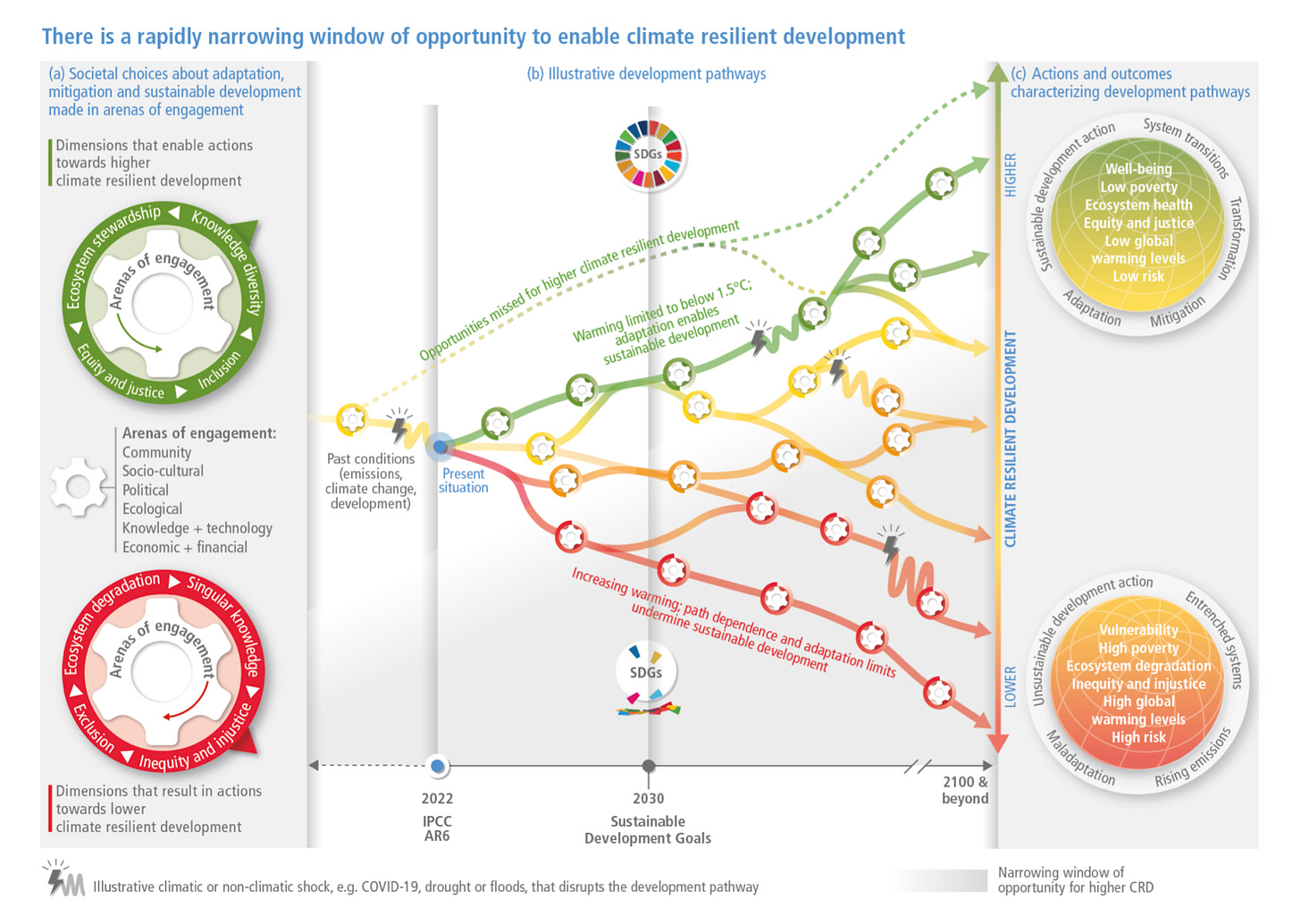

The latest report from the Intergovernmental Panel on Climate Change finds that human-caused climate disruption is happening everywhere, that the window for successful mitigation, adaptation, and resilience-building is rapidly closing, and that some regions are already coming up against both hard and soft barriers to adaptation. Food and water supplies are at risk of collapse, threatening the stability of financial systems and nation states.

The geophysical math is clear:

Rapidly reducing the proportion of all energy that comes from polluting fuels is a global financial and economic imperative.

Achieving economic development and future finance that reliably produce benefits and build stable, functioning, prosperous societies will require us to stop the degradation of natural systems that is currently taking place, and getting worse, due to worsening global heating.

The International Monetary Fund, the Financial Stability Oversight Council, the Commodity Futures Trading Commission, a global network of central banks, a working coalition of ministries of finance, and other mainstream financial institutions, recognize that to secure future value, spending and investment must foster climate resilient development.

4) Oil and gas dependency is being weaponized to limit the international response to war crimes.

The dependency of European energy markets on Russian oil and gas is being weaponized by Vladimir Putin, who has repeatedly used oil and gas exports to take lives, maximize political pressure, and extort concessions. Putin leverages global markets, where a reduction in supply can send prices soaring, to neutralize opposition from countries unfriendly to his corrupt authoritarian aims.

Putin has described coercive or punitive economic actions (sanctions against his regime) as “akin to declaring war”. This also amounts to a confession that his regime is actively at war with the entire world. His regime routinely uses fossil fuel exports as a tool to make room for his corrupt use of power. The pressure political leaders are experiencing now, which comes from import dependency built into international markets, is part of Putin’s weaponization of energy.

The most rational way forward is to rapidly move away from fossil fuels.

For years, the US, the EU, and allies, have been planning a comprehensive transition away from carbon pollution. As we noted above, this is clearly necessary, given our geophysical situation and the impact on financial and economic prospects. Even the oil and gas industry describes natural gas as a “bridge fuel”, meaning a bridge to the low-carbon future.

That transition is now underway.

One of the most valuable companies in world history produces electric vehicles, solar energy, and batteries to power homes and buildings and back up the grid.

More than 450 major financial institutions last year committed to realign one-third of all wealth on Earth with science-based zero emissions targets that would remove half of all global emissions over the next 9 years.

The best way to turn the rust belt into a reinvestment engine is by manufacturing the clean economy. $130 trillion is now looking for precisely this kind of opportunity. A short list of some of high-value clean economy manufacturing opportunities includes:

Wind turbines;

Solar photovoltaic systems;

Micro grid hardware;

Battery storage;

Electric vehicles;

EV infrastructure;

Mass electric transport;

Hybrid drive systems for cargo ships;

Net zero emissions aircraft;

Low-carbon smelting technologies;

Biodegradable biopolymers;

New ultra lightweight and/or smart materials.

If the pace of electrification is quick enough to devalue future fossil fuel production, the effect of reduced supply on prices would be dampened. What we are essentially facing is the need for fast-moving sustainable development pathways for some of the world’s major industrial economies. That is investable, highly valuable, generates benefits across society, and would reduce future cost and risk from climate disruption.

Recognizing these cost and benefit considerations, and the imperative of halting the flow of funds to Putin’s war, the European Union is announcing today a new energy policy that will see its reliance on Russian gas imports decline by 67-80% this year. Such an integrated strategy can also help the US enforce its new comprehensive import ban on Russian oil, gas, and coal.

We must not give evil an open zone of operation.

In 2014, the Geoversiv team joined with others in arguing that instead of prolonging Europe’s addiction to natural gas, it was necessary to accelerate the transition to zero emissions clean energy systems. The concern was how to punish Vladimir Putin for his illegal military invasion of Ukraine and his illegal occupation of the Crimean peninsula.

We knew then what needed to be done, but we have advantages now that we didn’t have then, in terms of technology, finance, and political will, to fully commit to decarbonization. We now have:

A global agreement to cooperatively decarbonize the global economy, backed up by a global commitment to phase out pollution subsidies;

Commitment by international financial institutions and major investors to invest in that rapid decarbonization;

Proven manufacturing and technologies that can be ramped up, replicated, and diversified, by a coordinated effort moving at wartime-speed;

More advanced, lightweight systems for distributed manufacturing and modular grid management;

Digital information and payments systems that can integrate across sectors and priorities to maximize efficiency.

We also have agreement from last year’s climate negotiations that Special Drawing Rights—fiscal rescue funds now worth more than $650 billion—should be used to catalyze climate-smart flows of capital across the world. And, major polluting industries know their business models need to evolve to align with society-wide transformation and refinancing.

A strong enough directional signal will counteract the short-term signal sent by erasing Russian exports from markets. The following levers of support can help lighten the heavy lift:

Wartime-speed production and deployment of clean energy systems;

Cooperative refinancing of energy and transport infrastructure and long-term contracts;

Coordinated interim management of existing supplies, to avoid price shocks;

Climate income policies to ensure households don’t see a net rise in costs from the higher risk, lower reward business environment for polluting fuels;

Complementary efforts to limit the shock value of embedded oil and gas costs.

The courageous people of Ukraine are reminding us all that you don’t build a better future by clinging to what can no longer work. You build a better future by refusing to accept the unacceptable and then using every talent and every tool to make that future a reality.

This article is a condensed version of a longer Resilience Intel brief, which examines the challenge of phasing out fossil fuel dependency at the speed required by multiple currently ongoing emergencies.