US financial regulators warn climate disruption threatens to destabilize entire system

The Financial Stability Oversight Council (FSOC) has issued a 133-page report recognizing climate disruption as an “emerging threat”. The Council has responsibility for monitoring potential threats to stability of the financial system. Through this report, US financial regulators have issued a stark and clearly stated warning:

Climate change is an emerging threat to the financial stability of the United States.

The report assesses material, market-related, and transition risks, and lays out a roadmap for addressing data gaps and reducing the overall systemic threat. It also calls for improved, integrated, and intelligently cross-referencing data systems, enhanced public climate-related disclosure, and building capacity to assess, manage, and reduce climate related financial risks.

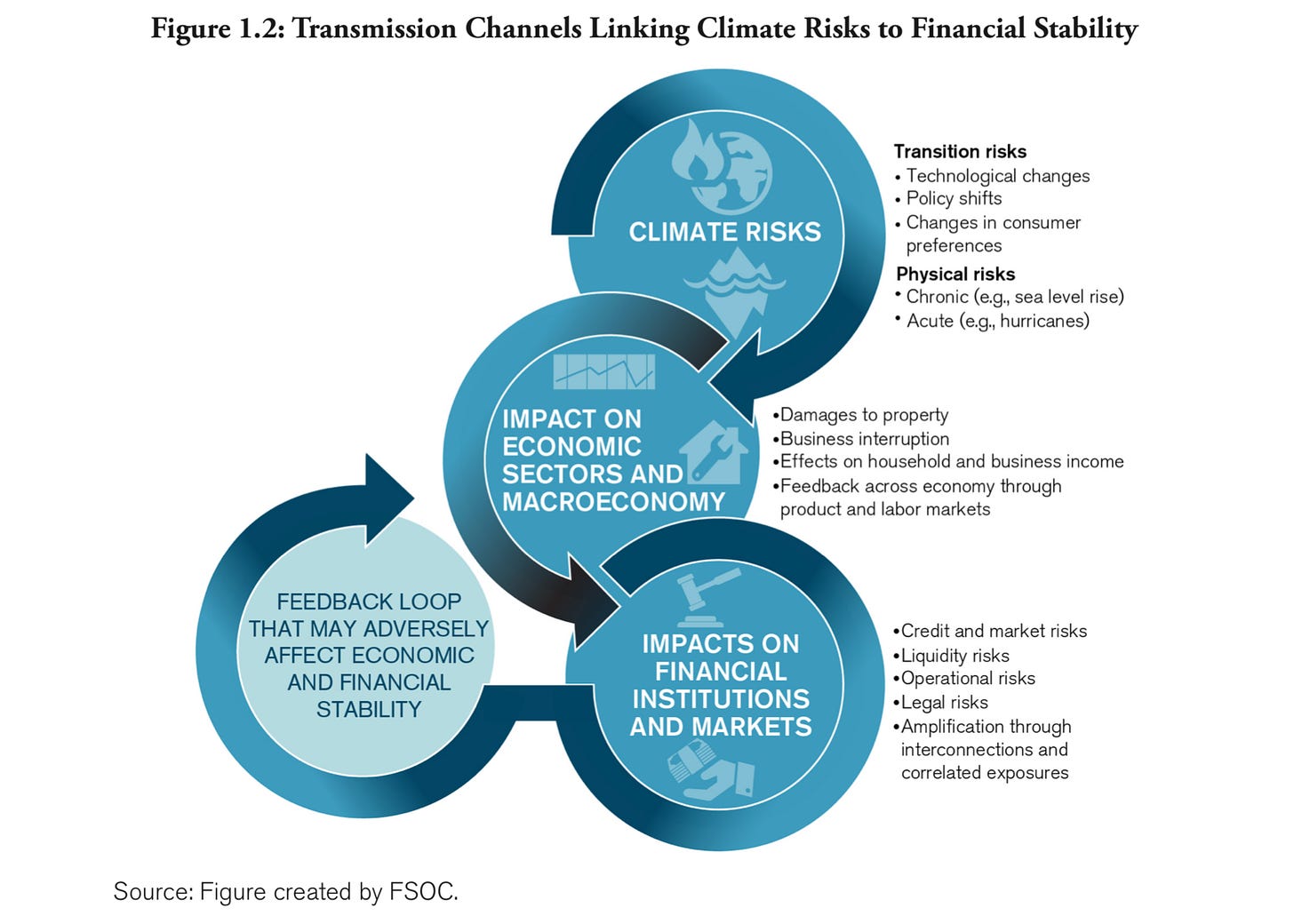

The FSOC report identifies the structural risk of cascade effects that could destabilize the financial system. This is an important breakthrough, because polluting industries transfer inefficiency and damage to human experience through the climate system, which does not recognize sectoral silos or political borders.

Identifying these complex “transmission channels” is a vital step to revealing the hidden costs of climate destabilization, distributed throughout the everyday economy and the living world. The historic failure to account for this harm has allowed global heating to accelerate, while an immense climate resilience deficit has built up, because policies, incentives, and market dynamics were not oriented toward mitigating the climate threat.

Tracing this cascade of compounding risks, the FSOC report notes:

Transition and physical risks associated with climate change will affect households, communities, businesses, and governments—damaging property, impeding business activity, impacting income, and altering the value of assets and liabilities… As a result, the financial sector may experience credit and market risks associated with loss of income, defaults and changes in the values of assets, liquidity risks associated with changing demand for liquidity, operational risks associated with disruptions to infrastructure or other channels, or legal risks.

The atmosphere of intensifying cost, risk, and uncertainty could result in withdrawal of credit and investment, “amplifying the initial climate-related shock and harming financial stability.” Insurers, for instance, will not be able to fund payments for far more frequent, widespread, and costly natural disasters, at a rate people and businesses can afford. The disappearance of insurance can cause finance, investment, enterprise, and revenue, to disappear.

The steadily rising cost of climate-related shocks means compounding cascade effects are becoming prohibitively expensive. A detailed, data-driven understanding of macrocritical resilience value—the degree to which a particular activity builds value beyond its balance sheet, for people and for nature—will soon be a market imperative.

The climate crisis and the COVID pandemic, and their costly convergence over the last 2 years, make clear the need to better identify and reduce hidden costs, what economists call “negative externalities”, and to find ways to generate numerous kinds of positive externality—enhanced value to others.

Complex data systems are beginning to connect, and to generate an entirely different category of market-shaping insight. As The Economist reports:

Troves of timely, granular data are to economics what the microscope was to biology, opening a new way of looking at the world.

Depersonalized data sets covering digital payments, restaurant bookings, GPS tracking information, hospital admissions, trace testing for COVID antibodies in sewage, security data relating to passage in and out of individual buildings, trends in climate bands and critical weather systems, soil moisture and drought trends, mapped to bioregions, all of these now can provide meaningful operational context for financial decision-making.

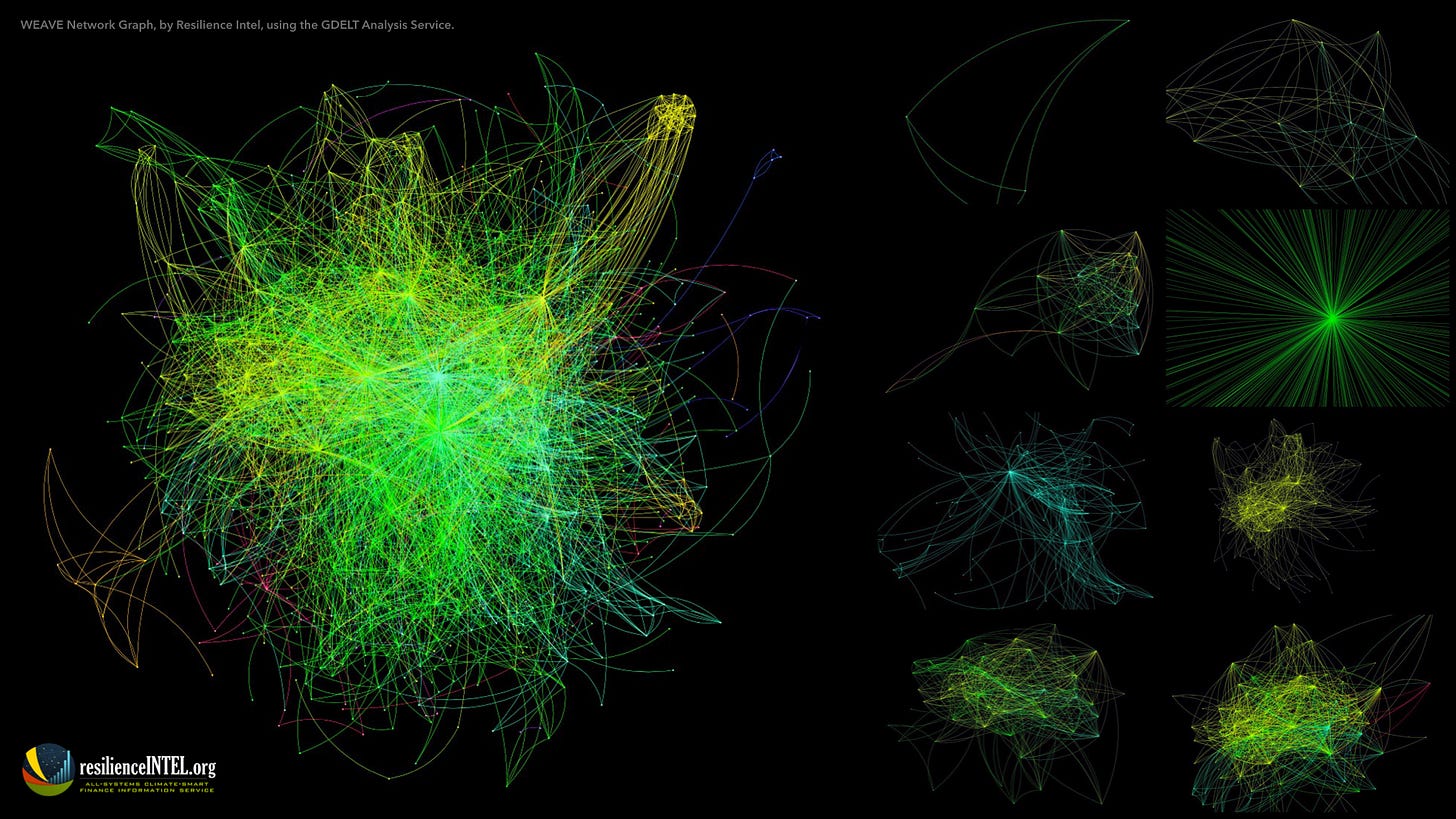

The Whole Earth Active Value Economy global knowledge graph (WEAVE GKG)—imaged above—tracks network relationships connecting:

water, climate, and biodiversity resilience to…

agriculture, food, finance, energy, infrastructure, science, shipping, watersheds, ocean health and resilience, forestry, and land use practices.

The graph draws from publication data, showing recurring incidence of institutions, individuals, industries, and public authorities, having reported contact with these 14 overlapping indicators. The thicker the resilience knowledge graph, the more likely an entity is to have contact with knowledge in that area. That could be experiential knowledge, from suffering a disaster impact, or a higher propensity for innovation in that area, due to a forward-looking program or competitive market dynamic.

COVID revealed that institutions with very thin WEAVE graphs were ill suited to make even small logistical adjustments in the face of a resilience shock. Some such institutions were heavily favored by expensive government intervention, yet failed to provide as much COVID adjustment value as much smaller, more local, less connected, or charitable institutions, many of which received no major assistance.

Last week’s landmark FSOC report makes clear that firms and institutions that decline to disclose climate-related risk in detail are in effect trying to game the system—potentially concealing overwhelming liabilities, while projecting a false picture of stability and efficiency. Markets are already beginning to view such non-reporting as suspicious and problematic.

The United States Intelligence Community—encompassing 18 agencies—also issued a report on climate-related risks last week, finding that:

climate change will increasingly exacerbate risks to US national security interests as the physical impacts increase and geopolitical tensions mount about how to respond to the challenge.

The report, released by the Office of the Director of National Intelligence (ODNI) also highlighted three major findings:

Geopolitical tensions are likely to grow…

The increasing physical effects of climate change are likely to exacerbate cross-border geopolitical flashpoints...

Intensifying physical effects of climate change… will increase the potential for instability and possibly internal conflict in highly affected countries.

It is not feasible for financial institutions, including major public sector financial actors, to continue to avoid detailed climate-related financial risk disclosures. The FSOC report lays out 35 recommended actions under four headings:

Building capacity and expanding efforts to address climate-related financial risks

Filling climate-related data and methodological gaps

Enhancing public climate-related disclosures

Assessing and mitigating climate-related risks that could threaten the stability of the financial system

We beginning to see the practical, everyday need for multi-system operational resilience data dashboards, and the industrial labs of economic, supply chain, and financial analysts needed to convert light-speed data flows into clear and actionable insights. New business models are emerging that are designed to generate positive externalities that can be traced by such impact evaluation engines.

The Race to Zero must also be a race to integrated understanding of Earth systems and the human impact of their health or degradation. Doing better is on climate, and for social good, is no longer an ideal; it is an imperative.

Read more about the Path to 100% Climate-Smart Finance and follow the integrated Earth systems finance revolution at ResilienceIntel.org