Structural income inequality puts everything we value at risk

Just over three years ago, I published the short note “Income inequality puts everything we value at risk”. At that time, the shocking news was that “The world’s wealthiest 42 individuals now hold as much wealth as the poorest 3.7 billion.” I described that fact as a “corrosive market failure” that was “driving a perversion of the whole economic landscape.”

The people of the United States had become accustomed to living with a level of generalized wealth, opportunity, and security, without fully valuing the critical ingredients of that situation. Far too large a share of new income going to capital was undermining a strong middle class, and creating conditions for economic collapse.

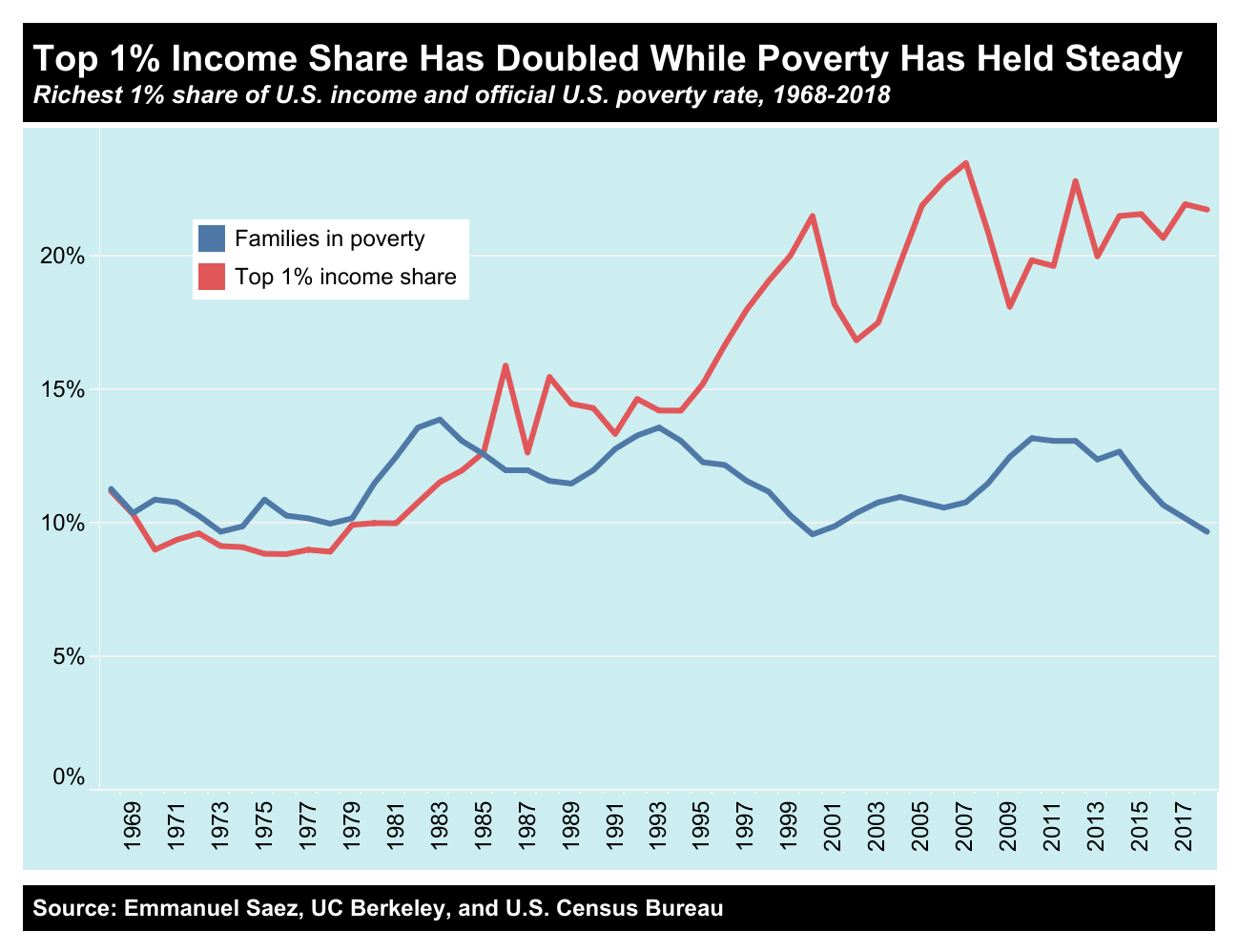

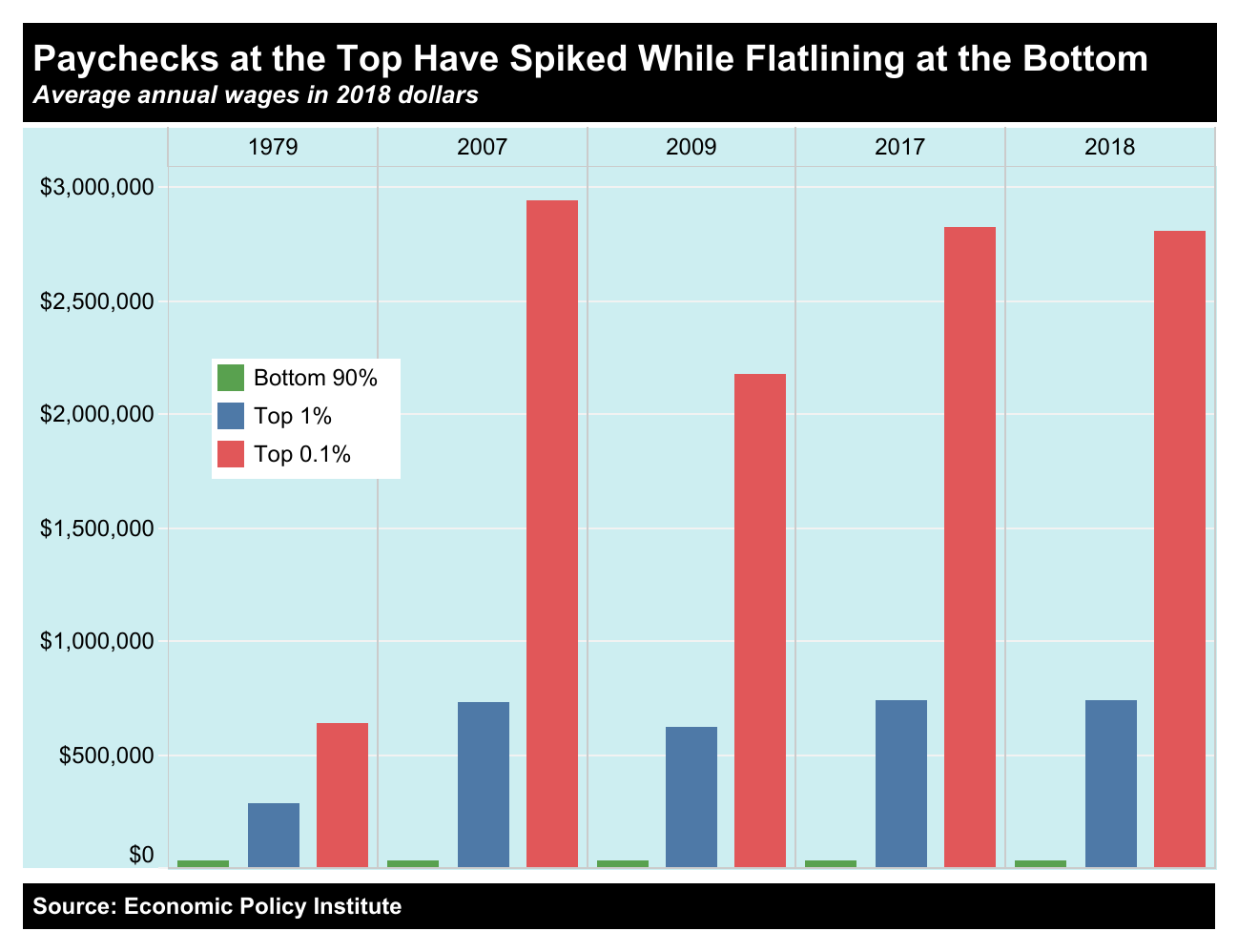

In 2018, the top 1/10 of 1% of American income earners took in 196 times as much on average as the bottom 90%. Since 1969, the overall poverty rate has remained roughly the same in the US, while the income of the top 1% has doubled.

Beyond that, the growth in income is now going almost exclusively to the richest of the rich. When graphing the comparison between average annual wages, on a graph that makes room for the extreme wealth of the top 0.1%, their income dwarfs even that of the top 1%, while the average annual wages of the bottom 90% are barely visible.

It is hard to imagine how a society that has this kind of income inequality can sustain a healthy middle class, let alone one that grows to include nearly everyone. That idea used to be “the American dream”—the idea that everyone would have the chance to live a life of economic dignity and empowerment, free from deprivation and structural injustice.

According to Inequality.org:

In 2018, the three men at the top of [the Forbes 400 list of American billionaires] — Amazon founder Jeff Bezos, Microsoft founder Bill Gates, and investor Warren Buffett — held combined fortunes worth more than the total wealth of the poorest half of Americans.

That means 3 people held more wealth than 165 million.

The COVID-19 pandemic is making inequality worse.

Recent analysis finds the combined wealth of America’s billionaires has increased by $1.3 trillion since mid-March of 2020. The report goes on to say:

The billionaires’ $1.3 trillion pandemic wealth gain alone could pay for over two-thirds of President Biden’s proposed $1.9 trillion COVID rescue package, which Congressional Republicans have attacked as too costly. At $4.2 trillion, the total wealth of America’s 664 billionaires is also more than two-thirds higher than the $2.4 trillion in total wealth held by the bottom half of the population, 165 million Americans.

According to Oxfam: the combined wealth of billionaires around the world increased by $3.9 trillion from March 18 through the end of 2020. Meanwhile, the combined earnings of workers fell by an estimated $3.7 trillion as people across the world lost work due to the pandemic, according to the International Labour Organization.

As we saw in 1929, 2008, and 2018, vast financial market gains are not grounded in the everyday improvement of economic conditions. Three years ago, we described this dynamic this way:

It’s a common-sense problem: If most people are watching real income decline while costs rise, there will be too little disposable cash to fund a vibrant middle class economy where hard work and entrepreneurship are rewarded. The resulting downward spiral will squeeze incomes still further, and capital will retreat to non-labor assets. The trend where capital share of income expands beyond what is sustainable, if unchecked, puts unbearable stress on the whole economy.

The current situation of unprecedented rapid rise in income inequality means a real economic recovery will be hard to achieve. The American Rescue Plan is a start, because it will provide much needed foundational income for families, and could help to bolster local economies, but as the Oxfam and ILO numbers above illustrate: the ARP is not nearly enough new investment to deal with the relative decline in average wealth, which will now become an economy-shaping force.

It is estimated that 100,000 businesses have permanently closed. If gaps are filled by major chains, that could further exacerbate inequality in new income gains and slow the rebuilding of community economies driven by local spending and local hiring.

Structural unfairness makes everything harder.

In January 2018, we warned that structural unfairness was intensifying, the previous President seemed unaware these moral boundaries are also mathematical boundaries, and high-cost tax cuts would expand the federal budget deficit and limit the government’s ability to respond to crisis.

One week after that article was published, the Dow Jones Industrial Average lost 1,175 points in its worst-ever single decline. The sudden and severe correction appeared to be signaling “a market-driven demand for the de-fictionalization of financial gain.”

2 days after the crash, we added “a note on the structural math”, highlighting the financial system’s relationship to incomes was deeply unhealthy:

Income: Virtually all income growth since 2000 has gone to the top 1% of income earners.

Incentives: The economy has been effectively restructured to make wage growth and financial gain rival forces.

Policy: No legislative or regulatory efforts currently under consideration will do anything to bridge this divide.

At the Berlin Energy Transition Dialogue earlier today, UN Climate Change chief Patricia Espinosa, observed:

Around USD 15 trillion are being spent globally on the recovery from COVID-19, and that figure is rising… Governments must spend the money properly to align investments with the goals of the Paris Agreement and the Sustainable Development Goals (SDG’s).

She is right on three levels:

We cannot afford to allow such far-reaching, fast-moving investment to fund destructive activities that will further degrade natural systems and generate further structural risks to human wellbeing.

The highest-value application of these major investments is the deployment of critical innovations that will make the sustainable, clean future possible.

The Sustainable Development Goals are a map of macrocritical forces—those aspects of human capability and wellbeing that shape all areas of value creation.

We need decentralized systems that build enhanced income potential into the fabric of the economy, for everyone, everywhere—including climate-smart agriculture, clean energy systems, Nature-positive practices and integrated data systems, and the diversification of rural and low-income community economies.

An economic landscape that is more structurally fair will benefit anyone who is able to build livable value for others. Only when everyone is empowered to be whole and sovereign economic actors will the economy align most constructively with human talent, good will, and the day-to-day needs and aspirations of real people.

Resources and Links

ILO report from March 2020 - warning of COVID-19 threat to human wellbeing and risk of deepening inequality

Inequality.org - tracking inequality-related news and views

Uplift Locally to Solve Globally - a Geoversiv article on human-scale resilience-building investment